Consumer debt has continued on a steep ascent, breaching $17 trillion for the first time in Q1. We also note a concerning but thus far modest upturn in delinquencies in certain credit categories. The Federal Reserve Bank of New York documents these trends but only issues updates on a quarterly basis, which is arguably too slow to be very useful; occam in contrast monitors various aspects of consumer credit on a daily basis, which allows portfolio managers an ability to track the financial health of the consumer in real time. Below, we examine trends in delinquency rates, explore the impact of the rising cost of living on consumer spending habits, and identify the demographic groups most impacted by the increasingly challenging economic conditions.

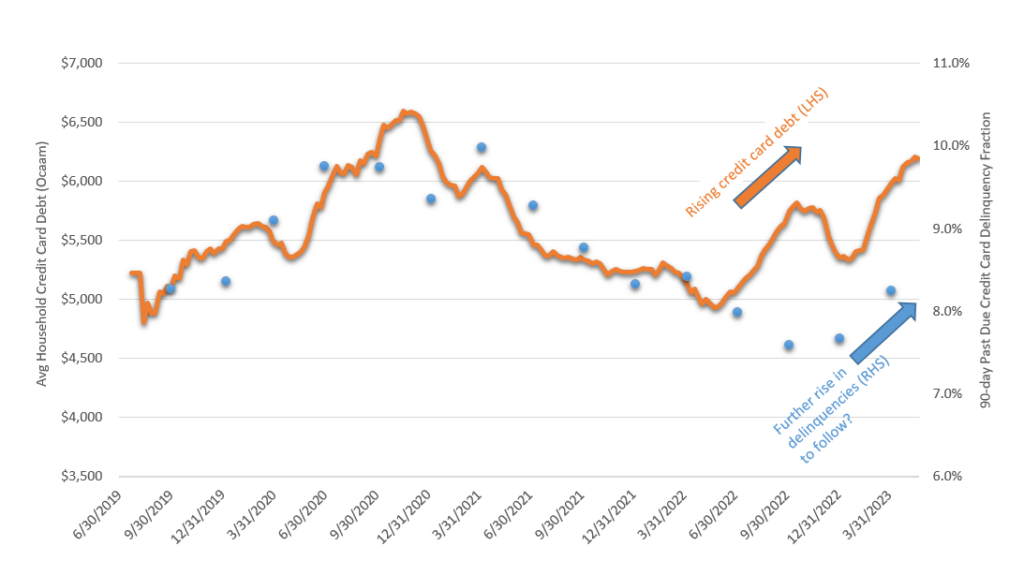

Credit Card Debt Level vs. Delinquencies

- Credit card debt level: Occam collects self-reported household credit card debt data daily, shown in orange with 7-day smoothing; in contrast, the NY Fed publishes estimates of credit card debt only quarterly, about six weeks after quarter end.

- Credit card delinquency rate: the NY Fed’s Quarterly Report on Household Debt and Credit gives the percentage of total credit card debt that is 90+ days delinquent, shown in blue.

- We believe occam’s household credit card debt level statistic leads NY Fed’s delinquency statistic by at least a few months because the Fed only recognizes delinquency once debt is overdue by a full 90 days, samples delinquency across a full quarter, and finally reports six weeks past quarter end. The Fed offers a “faster” version of the statistic where delinquency is based on being 30 days late, but this statistic is also sampled across a full quarter and is reported six weeks after quarter end.

- Credit card debt has been rising for the past year as consumers have struggled to meet the increasing cost of living. However, delinquencies only began to rise materially in Q1. Given our belief that our credit card debt statistic leads delinquencies by months, we think delinquencies will continue to rise.

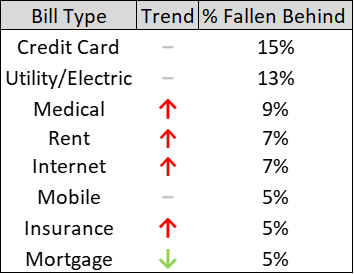

Categories Where Americans Have Fallen Behind

- Occam monitors categories of bills that Americans say they have fallen behind on in the last six months.

- Half the categories are trending in the wrong direction.

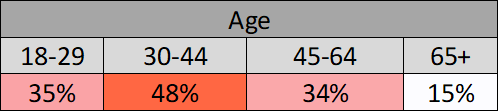

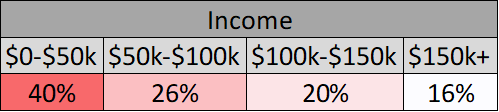

Demographics of Delinquencies

- According to occam, one-third of the American population has acknowledged falling behind on at least one type of bill in the last six months.

- Consistent with the findings from our last blog post on consumer debt, occam’s most recent data continues to highlight millennials and lower-income consumers as the groups experiencing the greatest financial stress.

Inflation and Consumer Spending

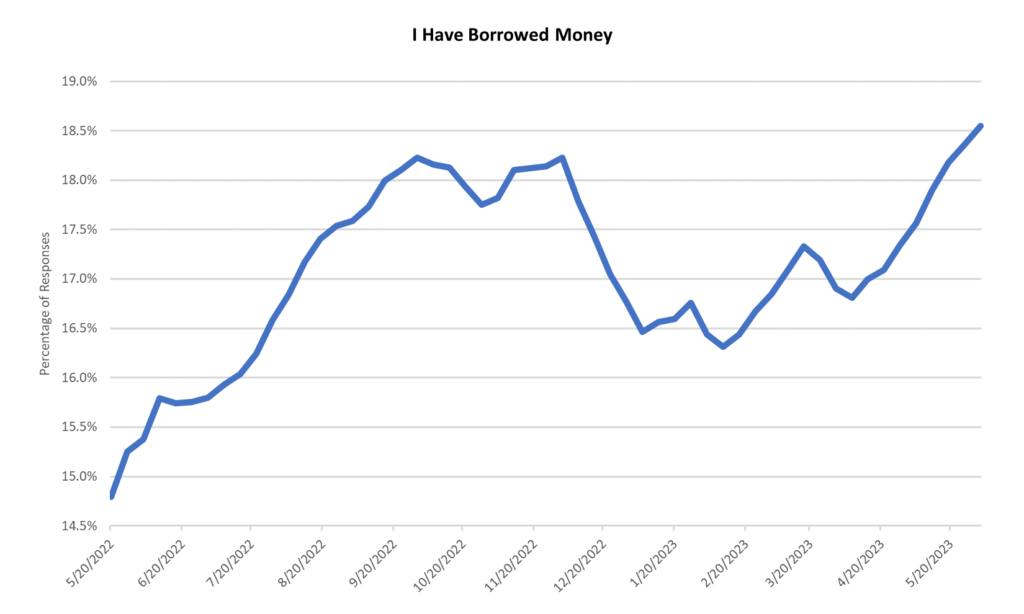

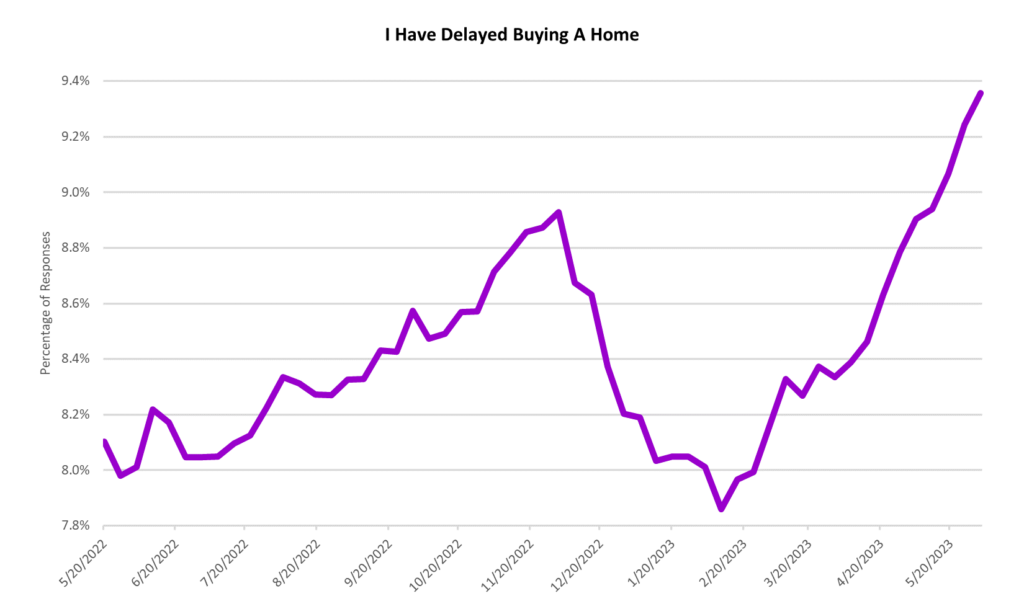

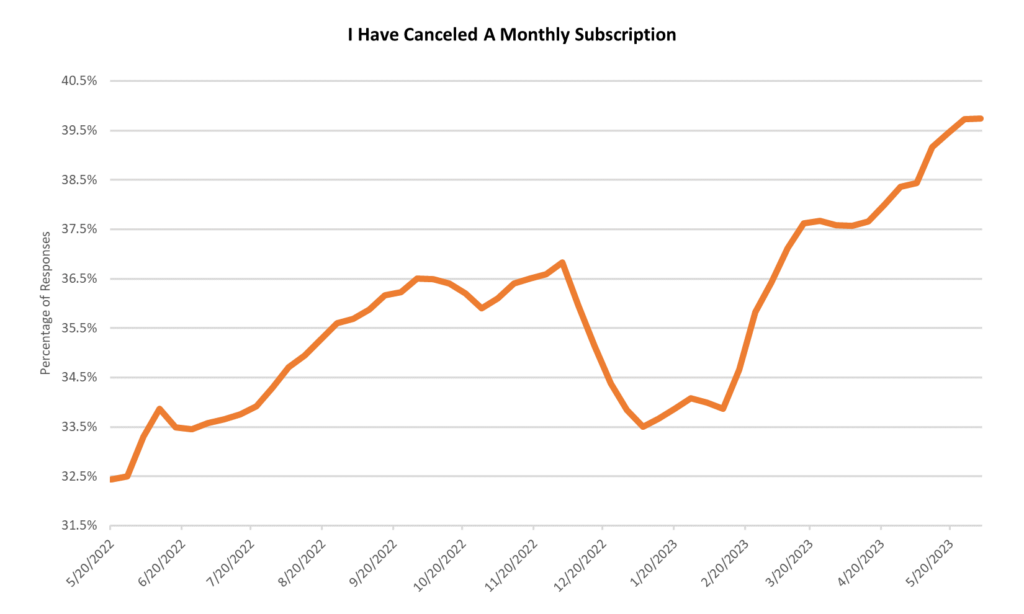

- Occam has has been monitoring for changes in the spending habits of Americans in response to escalating inflation.

- Americans are increasingly turning to borrowing to manage their escalating financial obligations.

- As we can see from the increase in subscription service cancellations and a delay of home purchases, consumers are cutting back on both minor and major expenditures.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.