Over recent years, most of the incumbent automakers significantly ramped up investments in electric vehicles (EVs), gearing up for what they collectively saw as an EV future. Among others, GM said they were aiming for an all-electric range by 2035, Ford for 100% EV sales by 2030, Mercedes for 100% zero-emission vehicles by 2030, and Volkswagen for 100% EV sales by 2033. This collective shift in focus is now manifesting in a rapidly accelerating supply of EVs. In 2022, EVs comprised approximately 5.8% of new vehicles sold in the US, and in Q3 2023, they comprised approximately 7.9%. But after years of tight EV supply, this rapid supply growth seems to have overtaken demand growth. Cox Automotive reports that as of the start of October, days of inventory for new internal combustion engine (ICE) vehicles stood at between 52 and 58 days, but days of inventory for new EVs (excluding Tesla and other direct-to-consumer brands) stood at a concerning 97 days. This growing disparity is driving manufacturers and dealers to roll out an increasing number of incentives to move EV inventory. Below, using insights from occam data, we look for shifts in consumer attitudes towards EVs and dissect the demographic drivers behind EV demand. (In a later blog, we will explore brand preferences among EV buyers – expect some surprises.)

Auto Market Dynamics

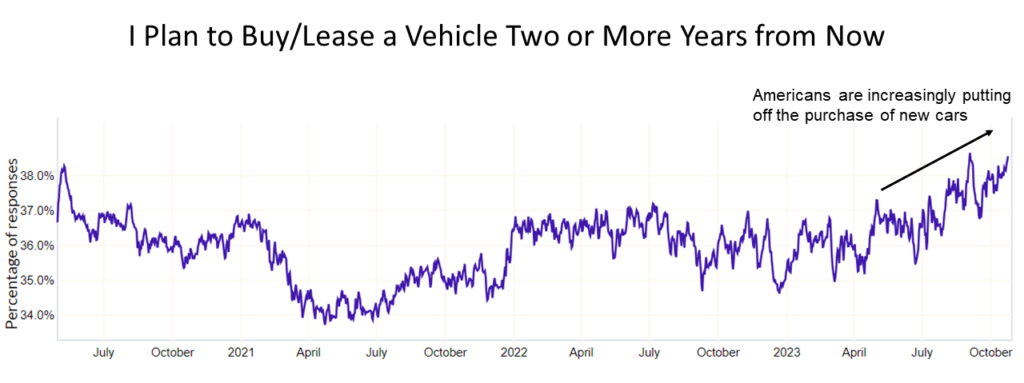

- With the cost of financing vehicles on the rise (80% of new car purchasers rely on financing) and with inflation putting a strain on household budgets, Americans are increasingly postponing vehicle purchases..

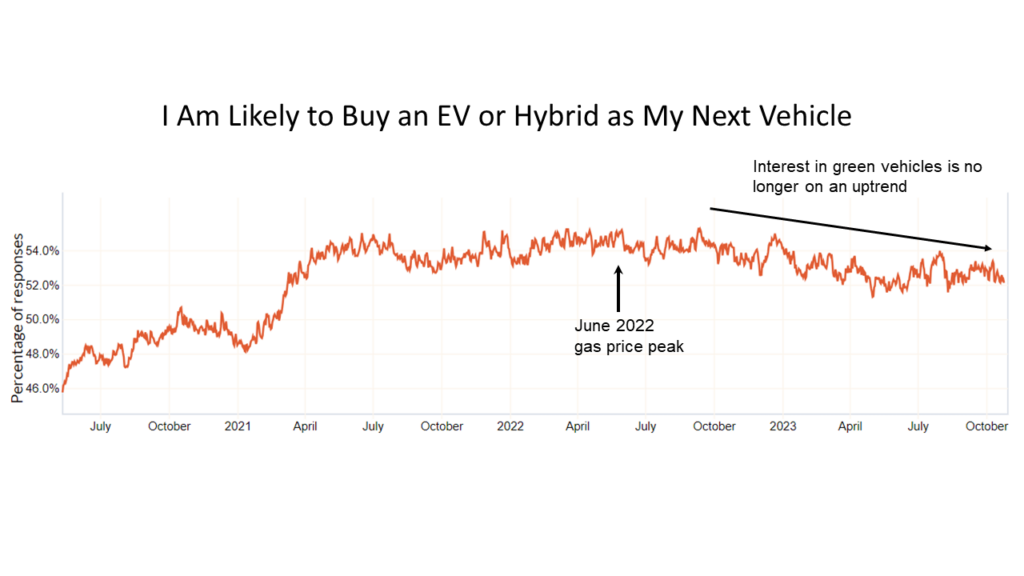

Consumer interest in green vehicles (hybrids and EVs) has stopped rising. In fact, interest seems to be gently softening, possibly because gas prices have moderated since summer 2022, while the prices of hybrids and EVs remain at a premium to conventional alternatives.

EV Purchase Intent

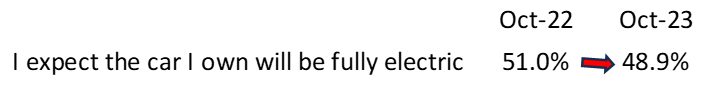

- One might expect a growing preference for EVs as they become more commonplace, but occam data doesn’t support this notion.

In fact, the proportion of those anticipating ownership of an EV by 2030 has experienced a slight decline over the last year.

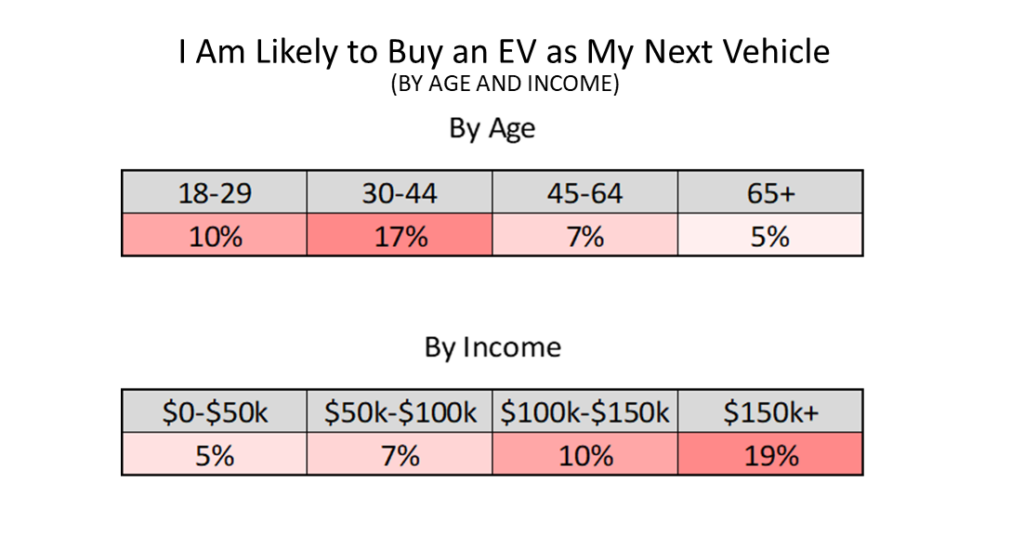

30-44 year olds is the age demographic most open to EVs. Higher income consumers are meaningfully more interested in EVs than lower income consumers, which is not surprising given the relative paucity of affordable EV models.

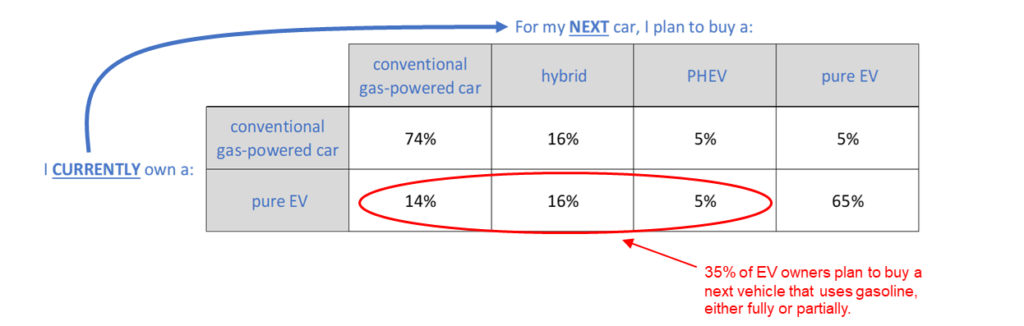

Occam reveals that an unexpectedly high 35% of current EV owners plan to buy next a vehicle that uses gas (whether conventional ICE, hybrid, or PHEV).

- Occam also suggests that hybrids may act as a stepping stone to EVs — 15% of hybrid owners (not shown) plan to buy an EV next, compared with only 5% of owners of conventional gas-powered cars.

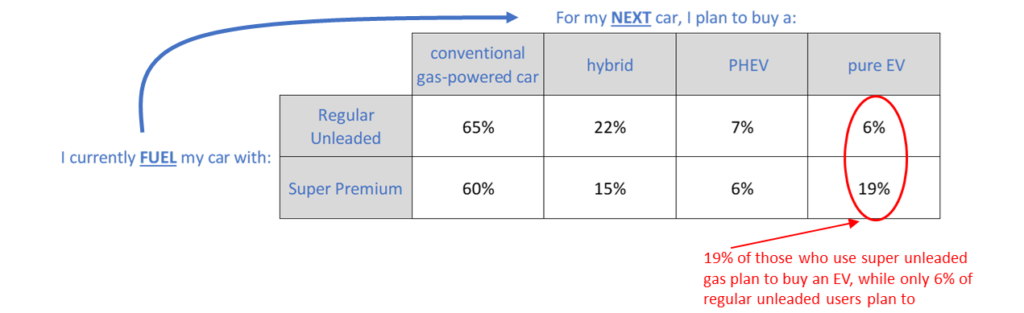

- Below we use fuel grade as a proxy for whether a respondent’s current vehicle is a luxury vehicle (which tend to use super premium) or non-luxury car (which tend to use regular unleaded). We observe that 19% of those who use super unleaded plan to buy an EV for their next vehicle, while only 6% of those who use regular unleaded plan to buy an EV. We interpret this as evidence that EVs are still perceived as luxury purchases.

- EV interest shows significant regional differences. Consistent with intuition, interest is strongest in the Pacific census division. Part of the difference in interest might be due to climate, but politics probably also play a role.

EVs and Politics

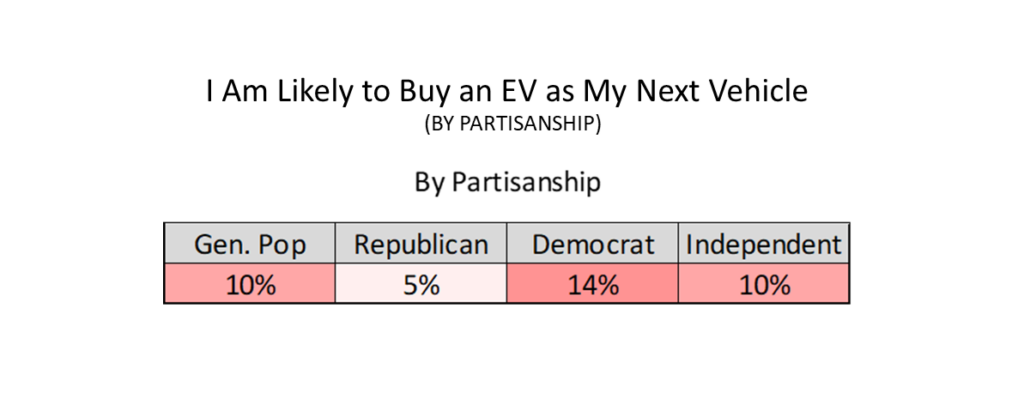

Interest in EVs is 2.8x higher among Democrats than Republicans

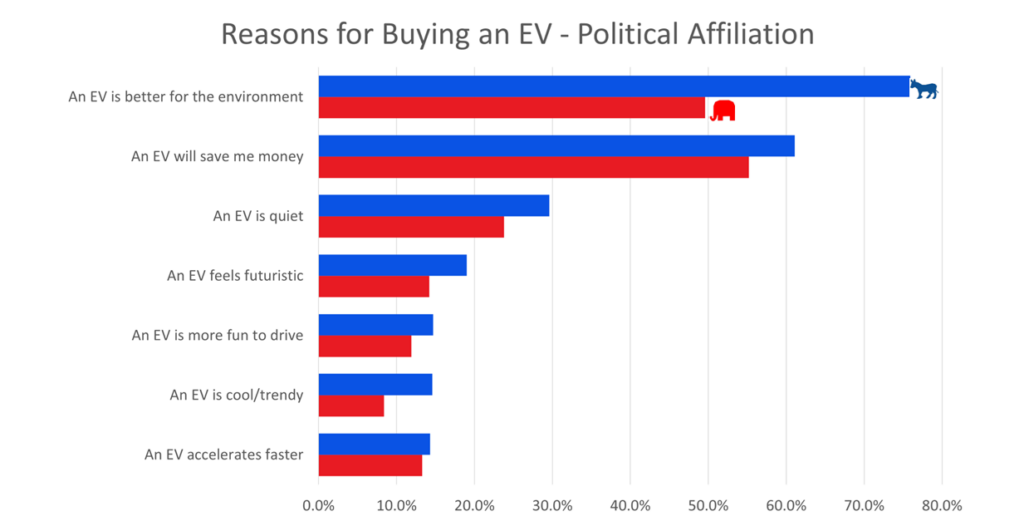

Republican respondents feel there are fewer benefits to EVs than Democrats do.

Similarly, Democrats have fewer concerns with EVs than Republicans do.

Source: Analysis based on occam™ proprietary AI-enhanced research platform with various data sources, including a wide range of questions asked to over 1000 respondents per day with over three years of history. Information is census-balanced and uses occam’s™ proprietary AI algorithm that ensures minimal sampling bias (<1%). Contact us for more info.

AlphaROC occam case studies are for illustrative purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees, data vendors, and advisors may hold positions, including contrary positions, in companies discussed in these reports. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described in these case studies will be profitable. Investors should consult with their advisors to determine the suitability of each investment based on their unique individual situation. Past performance is no guarantee of future results.